Asia Pacific Tax Hub

In a world reshaped by the COVID-19 pandemic, the Tax Hub will be instrumental in strengthening Domestic Resource Mobilization (DRM) and International Tax Cooperation (ITC) and in supporting developing member countries’ efforts to achieve the Sustainable Development Goals.

- Jump to:

- What's New

- Contacts

In the Spotlight

A Comparative Analysis of Tax Administration in Asia and the Pacific: Seventh Edition

Assessing how Asia and the Pacific can benefit from stronger tax systems, this comparative analysis drills down into the set-ups and performance of revenue bodies in 41 economies to highlight reform challenges and outline opportunities.

Tax Incentives and Investment

This brief analyzes how tax incentives are employed across Asia and the Pacific, looks at their effectiveness, and considers how they can best be used to encourage investment in activities with clear social benefits.

Tax Expenditure Estimation Tool Kit

This publication is designed to help tax analysts estimate revenue losses from tax expenditures and tax incentives. It presents the methodologies commonly used to estimate revenues forgone using varying sources of data.

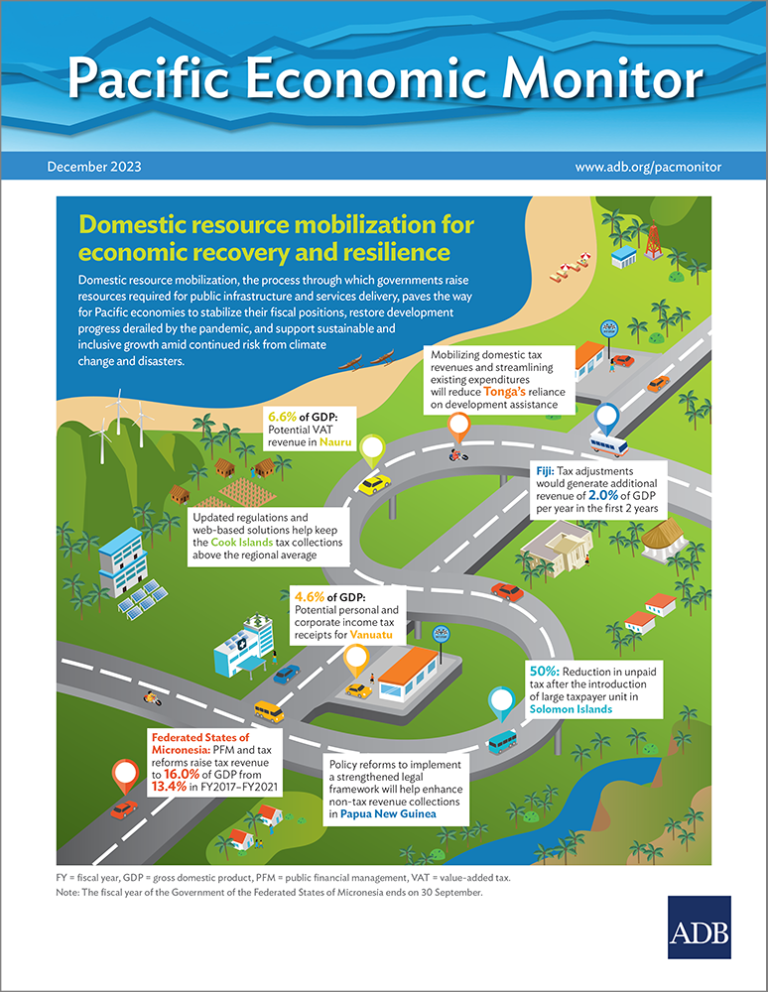

Pacific Economic Monitor – December 2023: Domestic Resource Mobilization for Economic Recovery and Resilience

Continued growth is expected in the Pacific, but governments need to generate additional resources for public infrastructure and services essential to sustaining economic development.

What's New

-

| Publications, Reports

A Comparative Analysis of Tax Administration in Asia and the Pacific: Seventh Edition

-

| Publications, Papers and Briefs

Tax Incentives and Investment

-

| Publications, Guides

Tax Expenditure Estimation Tool Kit

-

| Publications, Reports

Pacific Economic Monitor – December 2023: Domestic Resource Mobilization for Economic Recovery and Resilience

-

| Publications, Papers and Briefs

Excise Tax Policy and Cigarette Use in High-Burden Asian Countries

-

| News Releases, News from Country Offices

$400 Million ADB Loan to Boost Philippines’ Revenue Mobilization

Experts

Sandeep Bhattacharya

Senior Public Management Specialist (Tax)

E-mail contact form

Kaelen Onusko

Public Management Specialist (Taxation)

E-mail contact form